In Weare, residents face incessant debt collection calls on their cellphones, sparking privacy concerns. Federal laws like TCPA offer protection by allowing users to opt out of unsolicited communications. Balancing technology's advantages with privacy norms is crucial for ethical debt collection. Locals advocate for transparent practices, using strategic communication and technology to manage debts effectively while preserving privacy. Protecting personal information, using landlines, and maintaining calmness during interactions are key steps in dealing with debt collectors.

In today’s digital age, where cellphone technology dominates communication, debt collection practices have evolved significantly. This article delves into the complex relationship between Weare residents and debt collection calls, exploring both the challenges and rights of individuals in navigating this landscape. From understanding legal rights to the impact of cellphone use on debt recovery, we offer insights that empower residents while promoting ethical collection strategies. Learn practical tips for maintaining privacy during these interactions.

Understanding Debt Collection Practices and Legal Rights

Debt collection practices have evolved significantly, especially with the rise of digital communication. Today, many debt collectors use cellphones to make automated calls or send text messages, a practice that has sparked debates about consumer privacy and protection. It’s crucial for Weare residents to understand their legal rights in such situations.

According to federal laws like the Telephone Consumer Protection Act (TCPA), consumers have the right to opt-out of certain types of cellphone communications from debt collectors. This means you can ask them to stop calling your mobile phone, and they must comply. Knowing and exercising these rights is essential for protecting yourself from harassing or unsolicited calls.

The Impact of Cellphone Technology on Debt Recovery

The rise of cellphone technology has significantly transformed the debt collection landscape. Unlike traditional landlines, mobile phones offer a more direct and personal means of communication, with higher call completion rates. This allows debt collectors to reach borrowers more efficiently, potentially increasing the effectiveness of their recovery efforts. Advanced cellphone features like SMS text messaging and mobile apps also provide alternative channels for delivering notices and updates, ensuring borrowers stay informed throughout the process.

However, this increased accessibility comes with its challenges. The sheer volume of calls can be overwhelming for both debtors and creditors alike, leading to potential harassment issues. Additionally, many individuals now use their cellphones as their primary means of communication, making it crucial for debt collection agencies to adhere to strict do-not-call lists and respect individual privacy preferences. Effective debt recovery in the digital age requires a balance between leveraging cellphone technology’s advantages and respecting modern communication norms.

Weare Residents: A Community's Perspective on Debt Calls

In the bustling community of Weare, residents have been navigating a peculiar challenge—debt collection calls on their cellphones. This issue has sparked a unique perspective among the locals, who are not just consumers but also part of a vibrant, close-knit neighborhood. Many Weare residents find these unexpected phone calls intrusive, especially since they often disrupt daily routines and peace of mind. With each ring, there’s a moment of apprehension, as the caller’s identity remains hidden behind automated systems.

The community’s collective sentiment is one of frustration and confusion. Why are they being targeted for debt collection when their financial records may not even reflect such obligations? This mysterious aspect has fostered a sense of distrust among residents, who now approach these calls with caution. As a result, Weare residents are advocating for greater transparency and consumer protection, ensuring that debt collection practices respect the privacy and dignity of every individual within their community.

Strategies for Effective and Ethical Debt Collection

In the realm of debt collection, striking a balance between recovering outstanding balances and maintaining ethical practices is paramount. For weare residents facing incessant phone calls from collectors, it’s crucial to understand their rights and explore strategies to mitigate the impact on daily life. One effective approach is to establish clear communication channels. Debtors can request verification of the debt, ensuring the details are accurate, and demanding proof of the original agreement. This process, often facilitated through written correspondence or secure online portals, helps clarify terms and conditions, especially when dealing with outdated or misunderstood obligations.

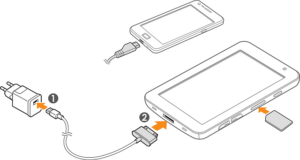

Additionally, many consumers find success in negotiating repayment plans tailored to their budget. Debt collectors often have the flexibility to arrange reasonable payment structures, allowing weare residents to regain control of their finances while settling outstanding debts. Furthermore, leveraging technology is beneficial; using a cellphone app or online platform for secure payments can enhance transparency and convenience, fostering a collaborative environment between debtors and collectors. These strategies not only ensure ethical collection practices but also empower individuals to manage their financial obligations effectively.

Protecting Your Privacy: Tips for Dealing with Debt Collectors

Protecting your privacy is a crucial aspect of dealing with debt collectors, as these interactions can be highly sensitive. When a debt collector contacts you, whether via phone, mail, or email, make sure to keep your personal information secure. Never reveal sensitive data such as your Social Security number, bank account details, or credit card numbers over the phone unless you have initiated the call and are certain of the collector’s legitimacy. It’s recommended to use a landline for these conversations instead of your cellphone, as it offers more protection under privacy laws.

Additionally, be mindful of where you are when taking such calls. Avoid discussions about your financial situation in public places or areas where others might overhear. Debt collectors cannot legally harass or threaten you, so remain calm and assert your rights. You can request verification of the debt and refuse to discuss payment until you have confirmed the details with your own records. Keep detailed notes on each interaction, including dates, times, and any promises made by the collector, for future reference and to ensure they adhere to legal guidelines.